title: What is a Balance Sheet? Understanding Its Components and Importance date: 2023-08-23 author: John Doe description: Discover what a balance sheet is, its key components, and why it's essential for businesses. Learn how to read and interpret balance sheets to make informed financial decisions. tags: [Finance, Accounting, Balance Sheet, Financial Statements]

What is a Balance Sheet? Understanding Its Components and Importance

In the world of finance and accounting, the balance sheet stands as one of the most vital financial statements. Whether you're a business owner, investor, or financial enthusiast, understanding what a balance sheet is and how it works can provide invaluable insights into a company's financial health.

What is a Balance Sheet?

A balance sheet, also known as the statement of financial position, is a financial statement that provides a snapshot of a company's financial standing at a specific point in time. It outlines the company's assets, liabilities, and shareholders' equity, offering a clear view of what the company owns and owes.

Key Components of a Balance Sheet

The balance sheet is divided into three main sections: assets, liabilities, and shareholders' equity. Here's a closer look at each component:

1. Assets

Assets are resources owned by the company that have economic value and can be converted into cash. They are typically categorized into two sections:

-

Current Assets: These are assets that are expected to be converted into cash or used up within one year. Examples include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Prepaid expenses

-

Non-Current Assets: Also known as long-term assets, these are assets that will be held for more than one year. Examples include:

- Property, plant, and equipment (PP&E)

- Intangible assets (e.g., patents, trademarks)

- Long-term investments

2. Liabilities

Liabilities are the company's obligations or debts that need to be settled in the future. Just like assets, liabilities are divided into two categories:

-

Current Liabilities: These are obligations that the company expects to pay within one year. Examples include:

- Accounts payable

- Short-term loans

- Accrued expenses

- Unearned revenue

-

Non-Current Liabilities: These are long-term obligations that are due beyond one year. Examples include:

- Long-term loans

- Bonds payable

- Deferred tax liabilities

3. Shareholders' Equity

Shareholders' equity, also known as owners' equity, represents the residual interest in the company's assets after deducting liabilities. It is comprised of the following:

- Common Stock: The value of shares issued to shareholders.

- Retained Earnings: The accumulated net income that has been retained in the company rather than distributed as dividends.

- Additional Paid-In Capital: The amount of capital received from shareholders in excess of the par value of the stock.

The Balance Sheet Equation

The balance sheet is based on the fundamental accounting equation:

[ \text{Assets} = \text{Liabilities} + \text{Shareholders' Equity} ]

This equation illustrates that what the company owns is financed by what it owes (liabilities) and by what shareholders have invested (equity).

Why is a Balance Sheet Important?

1. Financial Health Assessment

A balance sheet provides a comprehensive view of a company's financial health. By analyzing the assets, liabilities, and equity, stakeholders can determine the company's liquidity, solvency, and overall financial stability.

2. Decision Making

For business owners and managers, the balance sheet aids in informed decision-making. It helps in assessing the efficiency of resource utilization, identifying areas requiring improvement, and planning for future growth.

3. Investor Insight

Investors use the balance sheet to evaluate the company's financial performance and stability. By examining key metrics and ratios derived from the balance sheet, investors can make informed investment decisions.

4. Creditworthiness

Lenders and creditors rely on the balance sheet to determine the company's ability to meet its financial obligations. A strong balance sheet increases the likelihood of obtaining loans and favorable credit terms.

How to Read and Interpret a Balance Sheet

To effectively read and interpret a balance sheet, consider these steps:

1. Review Assets and Liabilities

Compare the current and non-current assets to current and non-current liabilities. This gives an initial idea of liquidity and long-term financial obligations.

2. Examine Shareholders' Equity

Analyze the components of equity to understand how much shareholders have invested and how much profit has been retained in the business.

3. Calculate Key Ratios

Some commonly used ratios derived from the balance sheet include:

- Current Ratio: ( \frac{\text{Current Assets}}{\text{Current Liabilities}} )

- Debt-to-Equity Ratio: ( \frac{\text{Total Liabilities}}{\text{Shareholders' Equity}} )

- Return on Equity (ROE): ( \frac{\text{Net Income}}{\text{Shareholders' Equity}} )

These ratios provide insights into liquidity, leverage, and profitability.

Conclusion

Understanding what a balance sheet is and its components is fundamental to grasping a company's financial position. Whether you're a business professional, investor, or finance student, interpreting balance sheets can enhance your financial literacy and decision-making abilities. By regularly reviewing balance sheets, you can stay informed about a company's financial health and make strategic choices that drive success.

By incorporating this knowledge into your financial toolkit, you can better navigate the complex landscape of business finance and contribute to informed financial planning and analysis.

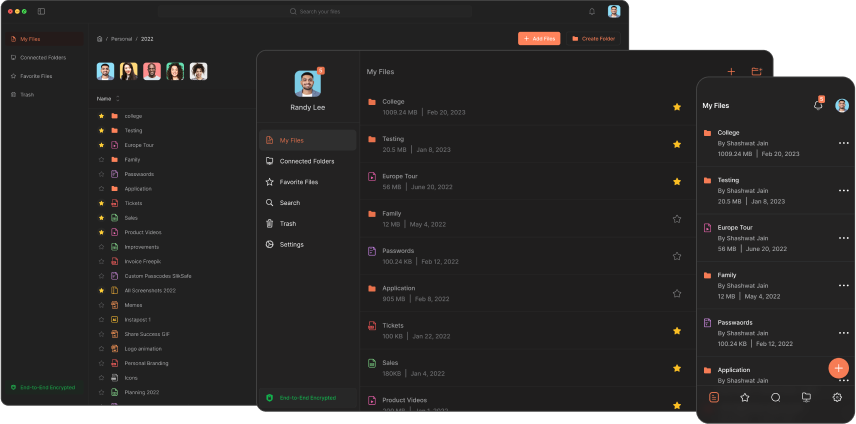

Download Now

The Slikest Files Experience Ever Made