Understanding The Sample Balance Sheet: A Comprehensive Guide

In the landscape of financial management, the balance sheet plays an instrumental role in providing a snapshot of a company's financial health. Whether you're an entrepreneur, an investor, or a financial analyst, understanding how to read and interpret a balance sheet is crucial. This blog post delves into the components of a sample balance sheet, offering a detailed and SEO-friendly exploration to help you navigate this vital financial statement.

What Is a Balance Sheet?

A balance sheet, also known as the statement of financial position, is one of the main financial statements used by businesses to report their financial condition at a specific point in time. It provides a summary of a company's assets, liabilities, and shareholders' equity. Unlike the income statement, which reflects performance over a period, the balance sheet offers a snapshot at a particular date.

Components of a Balance Sheet

The balance sheet is divided into two main sections: assets on one side and liabilities & shareholders' equity on the other. The fundamental equation underpinning the balance sheet is:

Assets = Liabilities + Shareholders' Equity

Here's a detailed breakdown of each component:

1. Assets

Assets are resources owned by the company that are expected to bring future economic benefits. Assets are usually categorized into current and non-current assets:

Current Assets

- Cash and Cash Equivalents: Money in the bank, checks, and other liquid assets.

- Accounts Receivable: Money owed to the company by customers.

- Inventory: Goods available for sale.

- Prepaid Expenses: Payments made in advance for services or goods.

Non-Current Assets

- Property, Plant, and Equipment (PP&E): Physical assets like land, buildings, machinery.

- Intangible Assets: Non-physical assets such as patents, trademarks.

- Long-term Investments: Investments in other companies or bonds held for more than a year.

- Goodwill: The excess of the purchase price over the fair value of the acquired business's net identifiable assets.

2. Liabilities

Liabilities are obligations that the company must settle in the future, typically categorized into current and non-current liabilities:

Current Liabilities

- Accounts Payable: Money owed by the company to suppliers.

- Short-term Debt: Loans and other borrowings due within a year.

- Accrued Liabilities: Expenses incurred but not yet paid.

- Deferred Revenue: Money received for goods/services yet to be delivered.

Non-Current Liabilities

- Long-term Debt: Loans and financial obligations payable beyond a year.

- Deferred Tax Liabilities: Taxes owed but deferred to future periods.

- Pension Liabilities: Future pension payments owed to employees.

3. Shareholders' Equity

Shareholders' equity represents the residual interest in the assets of the company after deducting liabilities. Key components include:

Common Stock

- Par Value: Nominal value of the company's common stock.

- Additional Paid-In Capital: Amount paid by investors over the par value of stock.

Retained Earnings

- Profit retained in the business after dividends are paid.

Treasury Stock

- Shares repurchased by the company.

Sample Balance Sheet

Here's a simplified example of a balance sheet in markdown format:

XYZ Corporation

Balance Sheet

As of December 31, 2023

| Assets | Liabilities and Shareholders' Equity | ||

|---|---|---|---|

| Current Assets | Current Liabilities | ||

| Cash and Cash Equivalents | $10,000 | Accounts Payable | $5,000 |

| Accounts Receivable | $18,000 | Short-term Debt | $2,000 |

| Inventory | $12,000 | Accrued Liabilities | $3,000 |

| Prepaid Expenses | $4,000 | Deferred Revenue | $1,000 |

| Total Current Assets | $44,000 | Total Current Liabilities | $11,000 |

| Non-Current Assets | Non-Current Liabilities | ||

| Property, Plant, and Equipment (PP&E) | $80,000 | Long-term Debt | $30,000 |

| Intangible Assets | $10,000 | Deferred Tax Liabilities | $5,000 |

| Goodwill | $5,000 | ||

| Total Non-Current Assets | $95,000 | Total Non-Current Liabilities | $35,000 |

| Total Assets | $139,000 | Total Liabilities | $46,000 |

| Shareholders' Equity | Common Stock | $50,000 | |

| Additional Paid-In Capital | $20,000 | ||

| Retained Earnings | $23,000 | ||

| Treasury Stock | -$0 | ||

| Total Shareholders' Equity | $93,000 | Total Liabilities and Shareholders' Equity | $139,000 |

Why Understanding a Balance Sheet Matters

Understanding a balance sheet is essential for multiple reasons:

- Evaluating Financial Health: Provides insights into the company's liquidity, solvency, and overall financial stability.

- Investment Decisions: Helps investors determine if a company is a good investment.

- Loan Approvals: Banks and financial institutions use balance sheets to assess loan eligibility.

- Business Strategy: Assists in making informed strategic decisions for growth and development.

Best Practices for Analyzing a Balance Sheet

- Compare Periods: Review balance sheets over multiple periods to identify trends.

- Analyze Ratios: Use financial metrics like the current ratio, debt-to-equity ratio, and return on equity.

- Benchmark Competitors: Compare the balance sheet with those of competitors in the same industry.

- Consult Professionals: When in doubt, consult financial analysts or accountants for deeper insights.

Conclusion

The balance sheet is an indispensable tool in the financial toolkit of any business. By understanding its components and utilizing best practices in analysis, you can make more informed financial decisions. Whether you're evaluating investment opportunities or steering your business towards growth, a firm grasp of the balance sheet will undoubtedly enhance your financial acumen.

Remember to bookmark this guide for future reference and feel free to share it with colleagues who might benefit from a deeper understanding of balance sheets.

By following these guidelines, you can ensure a comprehensive, SEO-friendly blog post that helps readers grasp the essentials of a sample balance sheet. Happy accounting!

Download Now

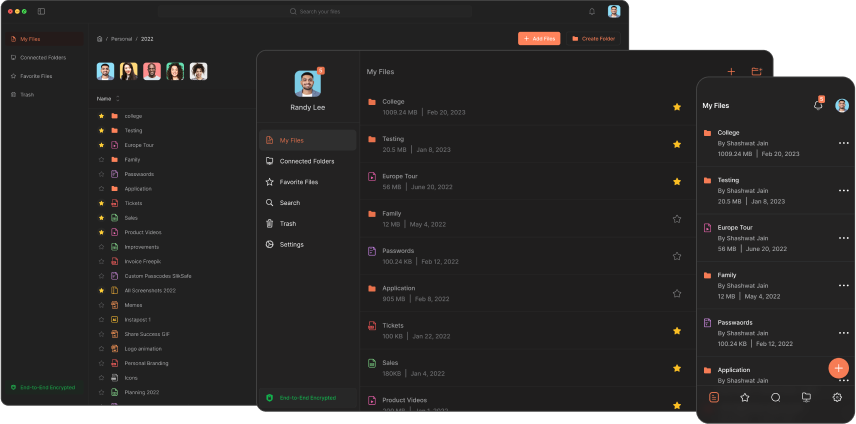

The Slikest Files Experience Ever Made