The Ultimate Guide to Creating a Personal Balance Sheet

Creating a personal balance sheet is a crucial step in managing your financial health. Similar to a business balance sheet, a personal balance sheet outlines your assets, liabilities, and net worth, providing a clear snapshot of your financial standing. In this comprehensive guide, we'll explore the components of a personal balance sheet, explain its benefits, and provide a step-by-step process for creating one. Additionally, we'll introduce you to useful tools, including the AI PDF Summarizer by Slik Safe, to help summarize financial documents and streamline your balance sheet creation process.

What is a Personal Balance Sheet?

A personal balance sheet is a financial statement that lists an individual’s assets and liabilities at a specific point in time. The difference between your assets and liabilities is your net worth. This document helps you understand where you stand financially and aids in making informed decisions about spending, saving, and investing.

Components of a Personal Balance Sheet

Assets

Assets are everything you own that has monetary value. They can be categorized into the following:

-

Current Assets:

- Cash

- Checking accounts

- Savings accounts

- Short-term investments

-

Fixed Assets:

- Real estate

- Vehicles

- Long-term investments (stocks, bonds, retirement accounts)

- Personal property (jewelry, collectibles)

-

Intangible Assets:

- Intellectual property

- Patents

Liabilities

Liabilities are your financial obligations or debts. They can be categorized into:

-

Current Liabilities:

- Credit card debt

- Short-term loans

- Unpaid bills

-

Long-term Liabilities:

- Mortgage

- Student loans

- Car loans

Net Worth

Net worth is calculated by subtracting your total liabilities from your total assets. The formula is:

Net Worth = Total Assets - Total Liabilities

A positive net worth indicates that you own more than you owe, while a negative net worth means you owe more than you own.

Benefits of Creating a Personal Balance Sheet

- Financial Awareness: Understand your financial position and net worth.

- Budgeting: Aid in creating realistic budgets based on your financial situation.

- Debt Management: Identify high-interest debts that need to be paid off first.

- Investment Planning: Determine how much you can invest and where.

How to Create a Personal Balance Sheet

Follow these steps to create your personal balance sheet:

Step 1: List Your Assets

Compile a list of all your current and fixed assets and their values. Don't forget to include intangible assets if applicable.

Step 2: List Your Liabilities

Document all your current and long-term liabilities along with their amounts.

Step 3: Calculate Your Net Worth

Use the formula mentioned earlier to subtract your total liabilities from your total assets to find your net worth.

Step 4: Use Financial Tools

Consider using financial tools to streamline the process. For instance, the AI PDF Summarizer by Slik Safe can help you summarize financial documents, making data gathering faster and more accurate.

Step 5: Review and Update

Review your personal balance sheet regularly and update it at least once a year to reflect any changes in your financial situation.

Tools to Simplify the Process

AI PDF Summarizer by Slik Safe

The AI PDF Summarizer can be particularly useful when dealing with extensive financial documents. This tool uses Generative AI to summarize PDF content, helping you extract important information quickly without sifting through pages of data.

Tips for Managing Your Personal Balance Sheet

- Track Expenses: Keep a close eye on your spending to avoid unnecessary liabilities.

- Focus on High-Interest Debts: Prioritize paying off debts with the highest interest rates.

- Invest Wisely: Make informed investment decisions based on your financial goals.

- Maintain an Emergency Fund: Ensure you have a safety net for unexpected expenses.

Conclusion

A personal balance sheet is a powerful tool that offers a clear picture of your financial health. By understanding your assets and liabilities, you can make better financial decisions, plan for the future, and work towards achieving your financial goals. Utilize tools like the AI PDF Summarizer by Slik Safe to simplify the process, and be sure to review and update your balance sheet regularly.

Start creating your personal balance sheet today and take control of your financial future!

By optimizing this article with relevant keywords and detailed sections, you’ll improve its visibility in search engines, making it easier for individuals seeking information on creating personal balance sheets to find this valuable resource.

Download Now

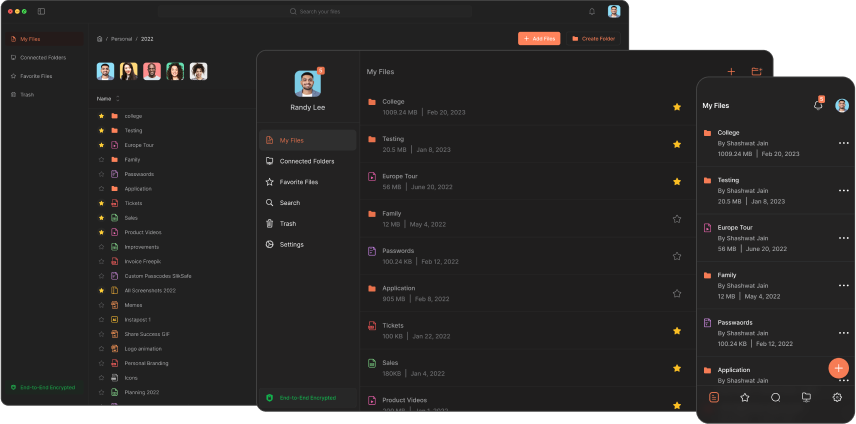

The Slikest Files Experience Ever Made