How to Make a Balance Sheet: A Detailed Guide

Creating a balance sheet is a fundamental aspect of accounting and financial reporting for any business. It provides a snapshot of a company's financial health at a specific point in time, detailing assets, liabilities, and shareholders' equity. Whether you're a seasoned accountant or a business owner looking to manage your finances better, understanding how to construct a balance sheet is crucial. In this blog post, we will guide you through the process step-by-step.

What is a Balance Sheet?

A balance sheet, also known as a statement of financial position, is a financial document that summarizes a company's financial condition at a specific point in time. It consists of three main components:

- Assets: Resources owned by the company.

- Liabilities: Obligations the company owes to others.

- Shareholders' Equity: The residual interest in the assets of the company after deducting liabilities.

Why is a Balance Sheet Important?

- Financial Health: Provides insights into the company’s financial stability.

- Investment Decisions: Helps investors assess the worthiness of investing in the company.

- Creditworthiness: Assists creditors in determining the risk of lending to the company.

- Performance Analysis: Enables management to track financial progress over time.

Components of a Balance Sheet

Before we dive into the steps to create a balance sheet, let’s understand its components in detail.

Assets

Assets are categorized into current assets and non-current assets.

-

Current Assets: These are assets that can be converted into cash within a year.

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Prepaid Expenses

-

Non-Current Assets: These are long-term investments or assets.

- Property, Plant, and Equipment (PPE)

- Intangible Assets (e.g., trademarks, patents)

- Long-term Investments

Liabilities

Liabilities are also divided into current liabilities and non-current liabilities.

-

Current Liabilities: These are obligations the company needs to settle within a year.

- Accounts Payable

- Short-term Loans

- Accrued Expenses

-

Non-Current Liabilities: These are long-term obligations.

- Long-term Loans

- Bonds Payable

- Deferred Tax Liabilities

Shareholders' Equity

Shareholders' equity includes the residual interest in the company's assets after deducting liabilities.

- Common Stock

- Retained Earnings

- Additional Paid-in Capital

- Treasury Stock

Step-by-Step Guide to Creating a Balance Sheet

Follow these steps to create a balance sheet.

Step 1: Identify Your Reporting Date and Period

Determine the specific date for your balance sheet as it reflects the financial condition on that day. Common reporting periods include month-end, quarter-end, and year-end.

Step 2: List Your Assets

Start with your current assets and then move to non-current assets.

Current Assets

- Cash and Cash Equivalents: $20,000

- Accounts Receivable: $15,000

- Inventory: $10,000

- Prepaid Expenses: $2,000

Non-Current Assets

- Property, Plant, and Equipment (PPE): $50,000

- Intangible Assets: $5,000

- Long-term Investments: $10,000

Total Assets = $112,000

Step 3: List Your Liabilities

First, list your current liabilities and then your non-current liabilities.

Current Liabilities

- Accounts Payable: $8,000

- Short-term Loans: $5,000

- Accrued Expenses: $3,000

Non-Current Liabilities

- Long-term Loans: $20,000

- Bonds Payable: $10,000

- Deferred Tax Liabilities: $5,000

Total Liabilities = $51,000

Step 4: Calculate Shareholders’ Equity

List the equity items such as common stock, retained earnings, etc.

Shareholders' Equity

- Common Stock: $30,000

- Retained Earnings: $25,000

- Additional Paid-in Capital: $5,000

- Treasury Stock: -$1,000

Total Shareholders' Equity = $59,000

Step 5: Verify the Equation

Ensure that:

Total Assets = Total Liabilities + Shareholders' Equity

In this case:

$112,000 = $51,000 + $59,000

The equation balances, indicating the balance sheet is correct.

Conclusion

Creating a balance sheet may seem daunting initially, but breaking it down into manageable steps simplifies the process. A balanced sheet not only ensures accurate financial reporting but also provides invaluable insights for strategic planning, investment decisions, and overall business management.

By following this detailed guide, you'll be able to accurately create a balance sheet, ensuring that your financial records are in order and that you have a clear view of your company's financial strengths and weaknesses.

Tags: #BalanceSheet #Accounting #FinancialReporting #BusinessFinance #SEO

By adhering to this comprehensive guide, you can confidently construct a balance sheet that aligns with professional accounting standards and leverages it for insightful financial analysis and planning. If you found this guide helpful, feel free to share it with your network.

Download Now

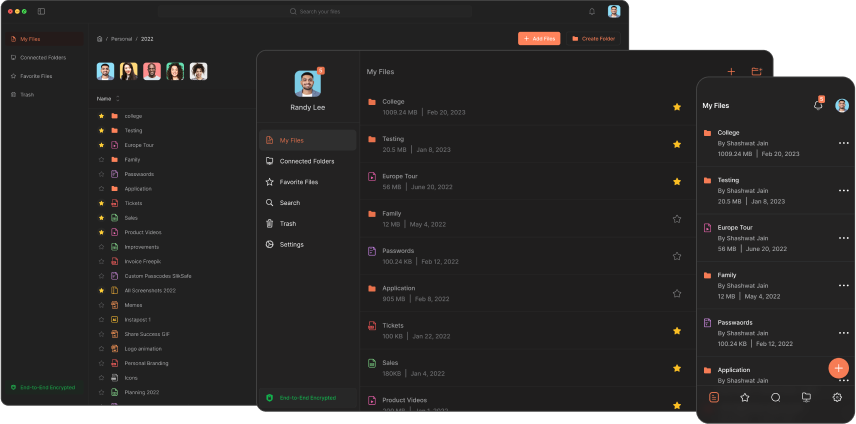

The Slikest Files Experience Ever Made