Example Balance Sheet: A Comprehensive Guide

In the world of financial accounting, a balance sheet is an essential document that provides a snapshot of a company's financial health at a specific point in time. Understanding and creating a balance sheet is crucial for businesses, investors, and financial analysts alike. This blog will explain the components of a balance sheet, provide an example, and guide you through the process of creating one.

What is a Balance Sheet?

A balance sheet, also known as a statement of financial position, is a financial report that lists a company's assets, liabilities, and shareholders' equity at a specific date. It follows the fundamental accounting equation: [ \text{Assets} = \text{Liabilities} + \text{Shareholders' Equity} ]

Components of a Balance Sheet

1. Assets

Assets are resources owned by the company that provide future economic benefits. They are typically categorized into current assets and non-current (long-term) assets.

- Current Assets: Cash, accounts receivable, inventories, etc.

- Non-Current Assets: Property, plant, equipment, long-term investments, etc.

2. Liabilities

Liabilities are obligations the company owes to external parties and are also categorized into current and non-current liabilities.

- Current Liabilities: Accounts payable, short-term loans, accrued expenses, etc.

- Non-Current Liabilities: Long-term debt, deferred tax liabilities, etc.

3. Shareholders' Equity

Shareholders' equity represents the residual interest in the assets of the company after deducting liabilities. It includes common stock, retained earnings, and additional paid-in capital.

Example Balance Sheet

Here is an example balance sheet of a hypothetical company, ABC Corporation, as of December 31, 2022:

ABC Corporation

Balance Sheet

As of December 31, 2022

| Assets | Liabilities and Shareholders' Equity | ||

|---|---|---|---|

| Current Assets | Current Liabilities | ||

| Cash | $50,000 | Accounts Payable | $15,000 |

| Accounts Receivable | $30,000 | Short-Term Loans | $10,000 |

| Inventory | $20,000 | Accrued Expenses | $5,000 |

| Total Current Assets | $100,000 | Total Current Liabilities | $30,000 |

| Non-Current Assets | Non-Current Liabilities | ||

| Property, Plant, Equipment | $200,000 | Long-Term Debt | $100,000 |

| Investments | $50,000 | Deferred Tax Liabilities | $20,000 |

| Total Non-Current Assets | $250,000 | Total Non-Current Liabilities | $120,000 |

| Total Assets | $350,000** | Total Liabilities | $150,000 |

| Shareholders' Equity | |||

| Common Stock | $50,000 | ||

| Retained Earnings | $150,000 | ||

| Total Shareholders' Equity | $200,000 | ||

| Total Liabilities and Shareholders' Equity | $350,000 |

Steps to Create a Balance Sheet

Step 1: Determine the Reporting Date and Period

Select the specific date for which you want to create the balance sheet. For example, December 31, 2022.

Step 2: List Your Assets

Organize the assets into current and non-current categories. Sum up each category and ensure the total assets value is calculated.

Step 3: List Your Liabilities

Similarly, classify liabilities into current and non-current. Sum up each category and ensure the total liabilities value is determined.

Step 4: Determine Shareholders' Equity

Calculate the shareholders' equity by summing up common stock, retained earnings, and any additional paid-in capital.

Step 5: Verify the Equation

Ensure that the total assets equal the sum of total liabilities and total shareholders' equity: [ \text{Assets} = \text{Liabilities} + \text{Shareholders' Equity} ]

Importance of a Balance Sheet

A balance sheet provides crucial insights into a company's financial stability and liquidity. It helps in assessing:

- Financial Position: Understanding the company's net worth.

- Liquidity: Evaluating the company's ability to meet short-term obligations.

- Debt Levels: Assessing the degree of financial leverage.

- Investments: Making informed decisions regarding business investments and growth.

Conclusion

A balance sheet is an indispensable tool for gauging a company's financial health. By understanding its components and learning how to create one, businesses and investors can make informed financial decisions. The example provided serves as a practical illustration of the balance sheet's format and the type of information it contains.

For more insightful financial guides and tools, stay tuned to our blog. Happy accounting!

FAQs

What is the difference between current and non-current assets?

Current assets are expected to be converted into cash within a year, while non-current assets are long-term and not easily liquidated.

Why is the balance sheet important?

It provides a snapshot of a company’s financial health, aiding in evaluating financial stability, liquidity, and overall net worth.

How often should a balance sheet be updated?

Typically, businesses prepare balance sheets quarterly and annually, but keeping it up-to-date more frequently can provide better financial insights.

Download Now

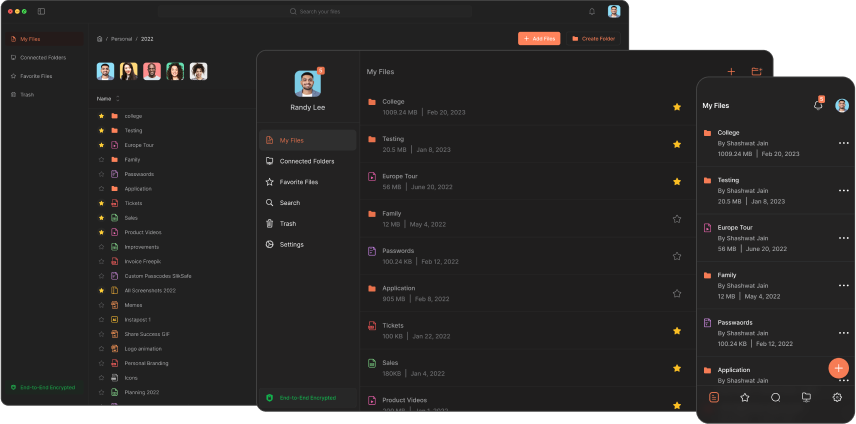

The Slikest Files Experience Ever Made