---

title: "Comprehensive Guide to Understanding Balance Sheets"

description: "Explore the essentials of balance sheets, their components, and how to effectively interpret and utilize them in your financial analysis."

keywords: ["Balance Sheet", "Financial Statements", "Accounting", "Assets", "Liabilities", "Equity", "Financial Analysis"]

author: "Your Name"

date: "2023-10-21"

---

# Comprehensive Guide to Understanding Balance Sheets

In the world of finance and accounting, balance sheets stand as foundational documents crucial for understanding a company’s financial health. This guide aims to demystify balance sheets, explain their core components, and provide actionable insights for effectively interpreting and utilizing them in financial analysis.

## What is a Balance Sheet?

A balance sheet, also known as a statement of financial position, provides a snapshot of a company's financial condition at a specific point in time. It helps stakeholders, including investors, management, and creditors, assess the company's assets, liabilities, and shareholders' equity.

## Components of a Balance Sheet

A balance sheet is divided into three main sections:

### 1. Assets

Assets represent the resources owned by the company that have economic value. They are typically classified into two categories:

#### **Current Assets**

Current assets are short-term in nature and can be converted into cash within a year. Examples include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Prepaid expenses

#### **Non-Current Assets**

Non-current assets are long-term investments not readily converted into cash. Examples include:

- Property, Plant, and Equipment (PPE)

- Intangible assets (e.g., patents, trademarks)

- Long-term investments

### 2. Liabilities

Liabilities are the company's obligations or debts that must be settled in the future. Similar to assets, liabilities are categorized into:

#### **Current Liabilities**

Current liabilities are obligations due within a year. Examples include:

- Accounts payable

- Short-term loans

- Accrued expenses

#### **Non-Current Liabilities**

Non-current liabilities are long-term obligations not due within the next year. Examples include:

- Long-term loans

- Bonds payable

- Deferred tax liabilities

### 3. Shareholders' Equity

Equity represents the residual interest in the assets of the company after deducting liabilities. It includes:

- Common stock

- Retained earnings

- Additional paid-in capital

## Importance of Balance Sheets

Balance sheets are vital for several reasons:

- **Financial Health Assessment**: They provide insights into the company’s liquidity, solvency, and financial stability.

- **Investment Analysis**: Investors use balance sheets to evaluate the risk and return of their investments.

- **Credit Evaluation**: Creditors assess balance sheets to determine the creditworthiness of a company.

- **Strategic Planning**: Management utilizes balance sheets for making informed decisions on resource allocation and financial strategy.

## How to Read a Balance Sheet

### **Step 1: Understand the Structure**

Start by familiarizing yourself with the format and organization of the balance sheet. Recognize the division into assets, liabilities, and equity.

### **Step 2: Analyze Assets and Liabilities**

Evaluate the liquidity of assets and the due dates of liabilities. Compare current assets to current liabilities to assess short-term financial health.

### **Step 3: Assess Shareholders’ Equity**

Examine the components of equity to understand the retained earnings and capital contributions from shareholders.

### **Step 4: Perform Ratio Analysis**

Use financial ratios like the current ratio, debt-to-equity ratio, and return on equity (ROE) to derive deeper insights from the balance sheet data.

## Tools for Analyzing Balance Sheets

Efficiently managing and analyzing balance sheets can be challenging. Leveraging advanced tools can streamline the process. The [AI-PDF Summarizer](https://www.sliksafe.com/tools/ai-pdf-summarizer) is a powerful tool that summarizes PDF documents, allowing you to quickly extract key information from extensive financial statements.

## Best Practices for Managing Balance Sheets

- **Regular Updates**: Continuously update balance sheets to reflect the company’s current financial status.

- **Accurate Recording**: Ensure all entries are accurate and comply with accounting standards.

- **Consistent Review**: Periodically review and analyze balance sheets to spot trends and make proactive decisions.

## Conclusion

Understanding balance sheets is crucial for anyone involved in the financial management of a business. By mastering the components and analysis of balance sheets, you can gain invaluable insights into a company’s financial health and make informed, strategic decisions. Utilize modern tools like the AI-PDF Summarizer to optimize your analysis process and maintain accuracy.

Download and start using the [AI-PDF Summarizer](https://www.sliksafe.com/tools/ai-pdf-summarizer) today to streamline your balance sheet analysis and enhance your financial management capabilities.

Download Now

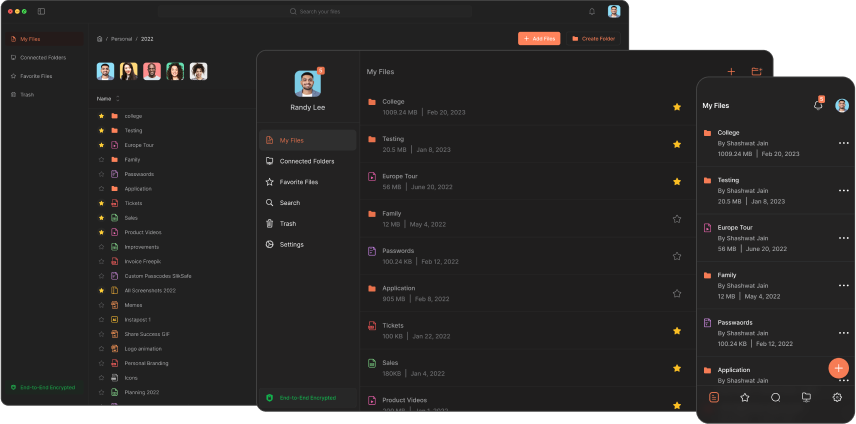

The Slikest Files Experience Ever Made

CompanyBlogsCareersFAQsAbout Us

ProductPricingDownload

SupportContact Us

LegalTerms of ServicePrivacy PolicySecurity

ToolsAll ToolsGetting StartedTips & TricksGenerative AIThe Future of AIDocument ManagementSecurityFAQs

BooksBook SummaryThe AlchemistWe'll Always Have Summer

Rainbow Labs Inc. | Copyright 2025 | v0.9.61