The Ultimate Guide to Balance Sheet Template: A Round-Up for Businesses

In the fast-paced world of finance and business management, understanding and effectively managing your company's financial health is crucial. One essential tool in this process is the balance sheet. This article will provide an in-depth look at balance sheet templates, their components, and how to use them effectively.

What is a Balance Sheet?

A balance sheet, also known as a statement of financial position, is a financial document that provides a snapshot of a company's financial status at a specific point in time. It outlines three main components: assets, liabilities, and shareholders' equity.

Why is a Balance Sheet Important?

Balance sheets offer several critical insights:

- Financial Health: Assess a company's financial stability.

- Liquidity: Understand the company's ability to meet short-term obligations.

- Efficiency: Evaluate how effectively assets are being utilized.

- Debt Management: Gauge the levels and management of debt.

Components of a Balance Sheet

A standard balance sheet is divided into two main sections - assets on one side and liabilities and shareholders’ equity on the other. Here’s a detailed breakdown:

Assets

Current Assets: Assets that are expected to be converted to cash or used within one year. This includes:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Short-term investments

Non-Current Assets: Long-term investments that cannot be quickly converted into cash. This includes:

- Property, plant, and equipment (PP&E)

- Long-term investments

- Intangible assets (e.g., patents, trademarks)

Liabilities

Current Liabilities: Obligations the company needs to settle within one year. This includes:

- Accounts payable

- Short-term loans

- Accrued liabilities

Non-Current Liabilities: Obligations that are due after more than one year. This includes:

- Long-term debt

- Deferred tax liabilities

- Long-term lease obligations

Shareholders’ Equity

This section represents the residual interest in the assets of the company after deducting liabilities. It includes:

- Common stock

- Retained earnings

- Additional paid-in capital

- Treasury stock (if applicable)

How to Create a Balance Sheet Template

Creating a balance sheet from scratch can be time-consuming, but utilizing a template can streamline the process. Here’s how you can create an effective balance sheet template:

Step 1: Title and Date

- Title the document as "Balance Sheet".

- Specify the date for the balance sheet (e.g., "As of December 31, 2023").

Step 2: Assets Section

- List all current assets with their respective amounts.

- Total the current assets.

- List non-current assets with their respective amounts.

- Total the non-current assets.

- Calculate the total assets by summing current and non-current assets.

Step 3: Liabilities Section

- List all current liabilities with their respective amounts.

- Total the current liabilities.

- List non-current liabilities with their respective amounts.

- Total the non-current liabilities.

- Calculate total liabilities by summing current and non-current liabilities.

Step 4: Shareholders’ Equity Section

- List all elements of shareholders’ equity with their respective amounts.

- Total the shareholders’ equity.

Step 5: Check Balance

- Ensure that total assets equal total liabilities and shareholders’ equity.

Sample Balance Sheet Template in Markdown

Balance Sheet Template

As of [Date]

Assets

Current Assets

- Cash and Cash Equivalents: $[Amount]

- Accounts Receivable: $[Amount]

- Inventory: $[Amount]

- Short-term Investments: $[Amount]

Total Current Assets: $[Total Current Assets]

Non-Current Assets

- Property, Plant, and Equipment (PP&E): $[Amount]

- Long-term Investments: $[Amount]

- Intangible Assets: $[Amount]

Total Non-Current Assets: $[Total Non-Current Assets]

Total Assets

Total Assets: $[Total Assets]

Liabilities

Current Liabilities

- Accounts Payable: $[Amount]

- Short-term Loans: $[Amount]

- Accrued Liabilities: $[Amount]

Total Current Liabilities: $[Total Current Liabilities]

Non-Current Liabilities

- Long-term Debt: $[Amount]

- Deferred Tax Liabilities: $[Amount]

- Long-term Lease Obligations: $[Amount]

Total Non-Current Liabilities: $[Total Non-Current Liabilities]

Total Liabilities

Total Liabilities: $[Total Liabilities]

Shareholders' Equity

- Common Stock: $[Amount]

- Retained Earnings: $[Amount]

- Additional Paid-in Capital: $[Amount]

- Treasury Stock: $[Amount] (if applicable)

Total Shareholders' Equity: $[Total Shareholders' Equity]

Total Liabilities and Shareholders' Equity

Total Liabilities and Shareholders' Equity: $[Total Liabilities and Shareholders' Equity]

Conclusion

A well-prepared balance sheet is vital for any business, providing critical insights into financial health and facilitating informed decision-making. Utilizing a balance sheet template can streamline the process, ensuring consistency and accuracy. Make sure to regularly update and review your balance sheet to keep track of your financial health.

By following this guide, you can create a thorough balance sheet that will help you manage your company's finances effectively. Download or create your own balance sheet template today and take control of your financial future.

Feel free to customize this template to suit your specific business needs. For a more detailed analysis and tools, check out our financial management resources for additional support.

Download Now

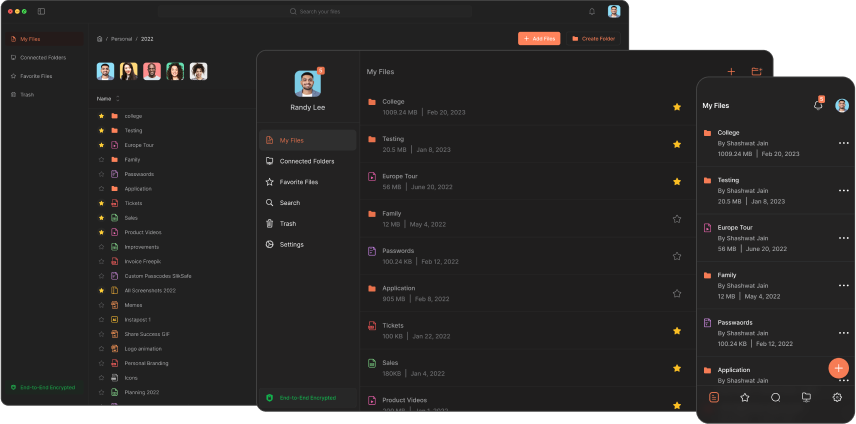

The Slikest Files Experience Ever Made