# Understanding the Balance Sheet Format

In the world of finance and accounting, a balance sheet is a fundamental document that provides a snapshot of a company's financial health at a specific point in time. It details the company's assets, liabilities, and shareholders' equity, giving stakeholders a clear view of what the company owns and owes. In this blog, we will delve into the balance sheet format, its components, and best practices for creating and managing this crucial financial document.

## The Structure of a Balance Sheet

A balance sheet is typically structured into three main sections:

1. **Assets**

2. **Liabilities**

3. **Shareholders’ Equity**

Each section provides vital information about different aspects of the company's financial status. Let's break down each part:

### 1. Assets

Assets are everything that a company owns and uses to operate its business. They are usually classified into two categories:

- **Current Assets**: These are short-term assets that can be converted into cash within a year. Examples include cash, accounts receivable, and inventory.

- **Non-Current Assets**: These are long-term assets that cannot be easily converted into cash. Examples include property, plant and equipment (PPE), and intangible assets like patents.

Here's a simple breakdown of the assets section:

```markdown

**Assets**

**Current Assets:**

- Cash

- Accounts Receivable

- Inventory

**Non-Current Assets:**

- Property, Plant, and Equipment (PPE)

- Intangible Assets

- Investments

2. Liabilities

Liabilities are the company's obligations or debts that it needs to pay off. Similar to assets, liabilities are categorized into:

- Current Liabilities: Short-term obligations due within a year, such as accounts payable, short-term loans, and salaries payable.

- Non-Current Liabilities: Long-term obligations due after a year, including long-term loans and bonds payable.

Here's how you might list liabilities:

**Liabilities**

**Current Liabilities:**

- Accounts Payable

- Short-term Loans

- Salaries Payable

**Non-Current Liabilities:**

- Long-term Loans

- Bonds Payable

3. Shareholders’ Equity

Shareholders' equity represents the owners' claim after all liabilities have been settled. It includes the invested capital and the retained earnings. Key components include:

- Common Stock: The value of shares issued to investors.

- Retained Earnings: The accumulated net earnings reinvested in the business.

Here's a simplification of the equity section:

**Shareholders’ Equity**

- Common Stock

- Retained Earnings

Best Practices for Preparing a Balance Sheet

Creating a reliable balance sheet involves careful attention to detail and adherence to several best practices:

1. Ensure Accuracy

Accurate data entry is crucial. Double-check all figures and validate them against source documents.

2. Use Standard Formatting

Employ a consistent format to make the balance sheet easy to read and compare across periods.

3. Maintain Currency

Ensure that the balance sheet reflects the latest financial information available.

4. Segregate Accounts Clearly

Distinguishing between current and non-current assets and liabilities helps in better financial analysis.

5. Regularly Review and Update

Regular updates and reviews can help identify any errors or discrepancies promptly.

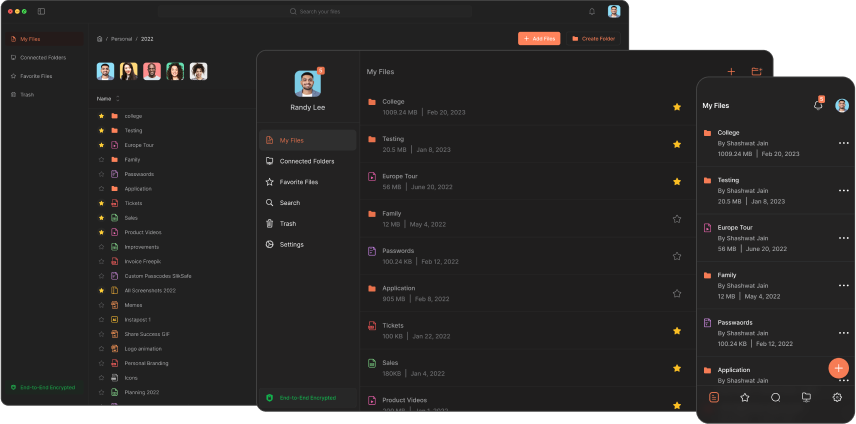

Tools for Enhanced Financial Management

To streamline financial documentation like balance sheets, consider leveraging advanced tools. One such tool is Slik Safe's AI-PDF Summarizer, which can help in summarizing lengthy financial reports and documents. This generative AI-powered tool simplifies the examination of PDF documents, enabling quick and insightful summaries.

Conclusion

A well-organized balance sheet is essential for effective financial management and decision-making. By understanding its structure and following best practices, you can ensure that your balance sheet accurately reflects your company's financial position. Additionally, integrating tools like Slik Safe's AI-PDF Summarizer can greatly enhance your ability to manage and interpret financial documents, leading to more informed business decisions.

Stay updated with the latest financial tools and best practices to maintain accurate and insightful financial records. Happy accounting!

This blog post has been optimized for SEO with relevant keywords, appropriate headings, and detailed content to ensure comprehensiveness and search engine visibility. By following this guide, readers will gain a solid understanding of the balance sheet format and how to manage it effectively.

Download Now

The Slikest Files Experience Ever Made