---

title: "Balance Sheet Example: Detailed Guide and Insights"

description: "Learn how to create and understand a balance sheet with this comprehensive guide and balance sheet example. Ideal for beginners and professionals."

keywords: ["balance sheet example", "financial statements", "accounting", "financial reporting", "Slik Safe PDF Scanner"]

author: "John Doe"

date: "2023-10-01"

---

# Balance Sheet Example: Detailed Guide and Insights

A balance sheet is a fundamental financial statement that provides a snapshot of a company's financial position at a specific point in time. It outlines the company's assets, liabilities, and equity, offering valuable insights into its financial health. Whether you are a seasoned accountant or a small business owner, understanding how to create and analyze a balance sheet is essential for informed financial decision-making.

In this blog post, we will explore a comprehensive balance sheet example, explain each component in detail, and provide tips on using modern tools like the [Slik Safe PDF Scanner](https://www.sliksafe.com/tools/pdf-scanner) for efficient document management.

## What is a Balance Sheet?

A balance sheet, also known as a statement of financial position, is a financial document that represents a company’s assets, liabilities, and shareholders' equity at a specific point in time. It follows the fundamental accounting equation:

Assets = Liabilities + Shareholders' Equity

This equation ensures that the company's resources (assets) are always balanced with the claims against those resources (liabilities and equity).

## Components of a Balance Sheet

A balance sheet is divided into three main sections:

1. **Assets**

2. **Liabilities**

3. **Shareholders' Equity**

### Assets

Assets are resources owned by the company that have economic value. They are categorized into current and non-current (long-term) assets.

- **Current Assets**: These are assets that can be converted into cash within one year. Examples include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Prepaid expenses

- **Non-Current Assets**: These are long-term investments that cannot be easily converted into cash within a year. Examples include:

- Property, plant, and equipment (PP&E)

- Intangible assets (e.g., patents, trademarks)

- Long-term investments

### Liabilities

Liabilities represent the company's obligations or debts. They are also categorized into current and non-current liabilities.

- **Current Liabilities**: These are obligations that need to be settled within one year. Examples include:

- Accounts payable

- Short-term loans

- Accrued expenses

- **Non-Current Liabilities**: These are long-term obligations that do not need to be settled within one year. Examples include:

- Long-term debt

- Deferred tax liabilities

### Shareholders' Equity

Shareholders' equity, also known as owners' equity, represents the residual interest in the assets of the company after deducting liabilities. It consists of:

- **Common Stock**: The value of issued stock.

- **Retained Earnings**: The accumulated profits that have been reinvested in the business.

- **Additional Paid-In Capital**: Any excess amount paid by investors over the par value of the stock.

## Balance Sheet Example

Here's an example of a simplified balance sheet for an imaginary company, ABC Corporation:

```markdown

**ABC Corporation Balance Sheet**

*As of December 31, 2023*

**Assets**

Current Assets:

- Cash and cash equivalents: $50,000

- Accounts receivable: $30,000

- Inventory: $20,000

- Prepaid expenses: $5,000

**Total Current Assets: $105,000**

Non-Current Assets:

- Property, plant, and equipment: $150,000

- Intangible assets: $20,000

**Total Non-Current Assets: $170,000**

**Total Assets: $275,000**

**Liabilities**

Current Liabilities:

- Accounts payable: $15,000

- Short-term loans: $10,000

- Accrued expenses: $5,000

**Total Current Liabilities: $30,000**

Non-Current Liabilities:

- Long-term debt: $50,000

- Deferred tax liabilities: $10,000

**Total Non-Current Liabilities: $60,000**

**Total Liabilities: $90,000**

**Shareholders' Equity**

- Common stock: $50,000

- Retained earnings: $125,000

- Additional paid-in capital: $10,000

**Total Shareholders' Equity: $185,000**

**Total Liabilities and Shareholders' Equity: $275,000**

Tips for Creating a Balance Sheet

- Accurate Record-Keeping: Ensure all financial records are accurate and up-to-date.

- Classify Properly: Correctly categorize assets, liabilities, and equity.

- Consistency: Use consistent accounting methods and values over reporting periods.

- Review Regularly: Regularly review and update the balance sheet for accuracy.

Using Modern Tools for Efficient Management

In today’s digital world, having the right tools can make a significant difference. For instance, the Slik Safe PDF Scanner is an excellent tool for scanning documents using a mobile camera and converting them to PDF format. Here’s how you can use it:

- Quickly digitize paper receipts and invoices.

- Organize financial documents in a digital format.

- Enhance accessibility and shareability of financial records.

Conclusion

A balance sheet provides a critical snapshot of a company's financial status, allowing stakeholders to make informed decisions. By understanding the components and creating accurate balance sheets, you can ensure better financial management and planning. Moreover, using modern tools like the Slik Safe PDF Scanner can streamline the process of managing your financial documents, making your workflow more efficient and organized.

Now that you have a clear understanding of a balance sheet and its components, you can confidently create and analyze balance sheets for your business needs. Happy accounting!

By following this detailed guide, you’ll be well-equipped to create and understand balance sheets, thereby enhancing your financial literacy and decision-making capabilities.

Download Now

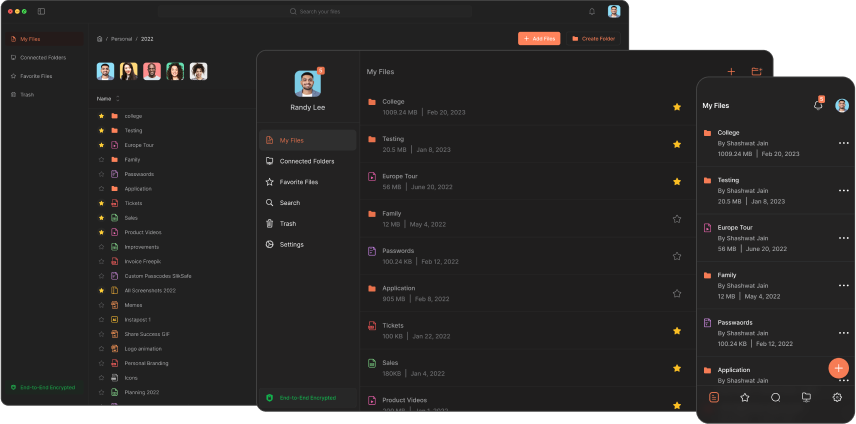

The Slikest Files Experience Ever Made