Understanding Balance Sheets: A Comprehensive Guide

In the world of finance and accounting, a balance sheet is a fundamental document that provides a snapshot of a company's financial health at a specific point in time. This blog aims to break down the components of a balance sheet and explain its significance for businesses, investors, and other stakeholders.

What is a Balance Sheet?

A balance sheet, also known as a statement of financial position, is a financial statement that outlines a company’s assets, liabilities, and shareholders' equity at a particular date. It provides a clear picture of what a company owns and owes, as well as the amount invested by shareholders.

Importance of a Balance Sheet

Understanding a balance sheet is crucial for several reasons:

- Financial Health: It provides insights into a company’s financial stability and liquidity.

- Investment Decisions: Investors use balance sheets to determine the financial viability of investing in a company.

- Creditworthiness: Lenders and creditors review balance sheets before approving loans or credit lines.

- Operational Efficiency: It helps in assessing how effectively a company uses its assets and manages liabilities.

Key Components of a Balance Sheet

A balance sheet is divided into three main sections: assets, liabilities, and shareholders' equity.

1. Assets

Assets are resources owned by a company that have economic value. They are categorized into:

Current Assets

- Cash and Cash Equivalents: Liquid funds available for immediate use.

- Accounts Receivable: Money owed to the company by its customers.

- Inventory: Goods available for sale.

Non-Current Assets

- Property, Plant, and Equipment (PP&E): Tangible long-term assets.

- Intangible Assets: Non-physical assets like patents, trademarks, and goodwill.

- Investments: Long-term investments held by the company.

2. Liabilities

Liabilities are obligations that a company needs to settle in the future. They are categorized into:

Current Liabilities

- Accounts Payable: Money the company owes to its suppliers.

- Short-term Debt: Loans and financial obligations due within one year.

- Accrued Expenses: Expenses that have been incurred but not yet paid.

Non-Current Liabilities

- Long-term Debt: Loans and financial obligations due after one year.

- Deferred Tax Liabilities: Taxes owed but not yet payable.

3. Shareholders' Equity

Shareholders' equity represents the residual interest in the assets of the company after deducting liabilities. It includes:

- Common Stock: Equity capital raised from shareholders.

- Retained Earnings: Profits not distributed as dividends and reinvested in the business.

- Additional Paid-in Capital: Excess amounts paid by investors over the par value of shares.

The Balance Sheet Equation

The balance sheet is based on the fundamental accounting equation:

[ \text{Assets} = \text{Liabilities} + \text{Shareholders' Equity} ]

This equation must always be in balance, reflecting that the resources owned by the company (assets) are financed either by borrowing (liabilities) or by contributions from the shareholders (equity).

How to Read a Balance Sheet

- Review the Date: Balance sheets provide data as of a specific date, typically the end of a fiscal quarter or year.

- Analyze Assets: Look at the liquidity and composition of the company’s assets.

- Examine Liabilities: Assess the company’s short-term and long-term obligations.

- Evaluate Shareholders' Equity: Understand how much money is invested by owners and retained from earnings.

Common Balance Sheet Ratios

Balance sheets are used to calculate several key financial ratios, such as:

- Current Ratio: [ \text{Current Assets} / \text{Current Liabilities} ]

- Debt to Equity Ratio: [ \text{Total Liabilities} / \text{Shareholders' Equity} ]

- Return on Assets (ROA): [ \text{Net Income} / \text{Total Assets} ]

These ratios help in evaluating the liquidity, leverage, and overall financial performance of the company.

Conclusion

A balance sheet is an essential tool for anyone involved in the financial aspects of a business, from owners and managers to investors and analysts. Understanding its components and how to interpret the data can provide invaluable insights into a company's financial condition and operational efficiency.

For those looking to delve deeper, always consider consulting with financial experts or analysts to get a more nuanced understanding of specific balance sheet items and what they imply for the business.

Download Now

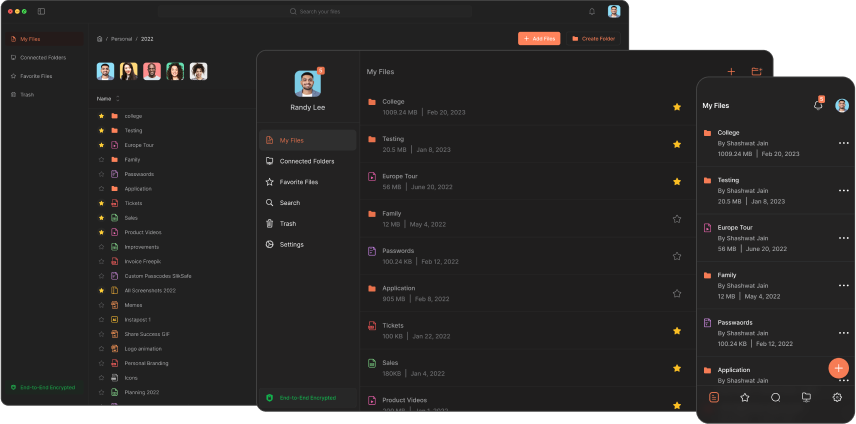

The Slikest Files Experience Ever Made