Understanding the Accounting Balance Sheet: A Comprehensive Guide

In the realm of finance and accounting, the balance sheet stands as one of the fundamental financial statements that provide insights into a company's financial health. Whether you're a business owner, investor, or financial analyst, grasping the concepts of the balance sheet is crucial for making informed decisions.

What is a Balance Sheet?

A balance sheet is a financial statement that presents a snapshot of a company's financial position at a specific point in time. It outlines the company's assets, liabilities, and equity, offering a clear picture of what the company owns and owes, as well as the shareholder's stake in the company.

Components of a Balance Sheet

The balance sheet is divided into three main components:

- Assets

- Liabilities

- Equity

1. Assets

Assets are resources owned by the company that provide future economic benefits. They are typically categorized into two types:

- Current Assets: These are short-term assets that are expected to be converted into cash within a year. Examples include cash, accounts receivable, inventory, and marketable securities.

- Non-Current Assets (Fixed Assets): These are long-term assets that are not easily converted to cash within a year. They include property, plant, equipment, long-term investments, and intangible assets such as patents and trademarks.

2. Liabilities

Liabilities represent the company's obligations or what it owes to others. They are also categorized into two types:

- Current Liabilities: These are obligations that need to be settled within a year. Examples include accounts payable, short-term debt, and accrued expenses.

- Non-Current Liabilities: These are long-term obligations that are due beyond one year. They include long-term loans, bonds payable, and deferred tax liabilities.

3. Equity

Equity represents the shareholder's residual interest in the company after deducting liabilities from assets. It is often referred to as the owner's equity or shareholder's equity. Equity includes:

- Common Stock: The par value of shares issued.

- Preferred Stock: The value of shares that have preferential rights over common stock.

- Retained Earnings: Cumulative earnings that are reinvested in the business rather than distributed as dividends.

Importance of a Balance Sheet

The balance sheet is crucial for several reasons:

- Assessing Financial Health: By analyzing the balance sheet, stakeholders can assess the company's liquidity, solvency, and overall financial stability.

- Investment Decisions: Investors use balance sheets to gauge a company's performance and make informed investment decisions.

- Creditworthiness: Creditors and financial institutions review the balance sheet to determine the company's creditworthiness before approving loans or credit lines.

- Operational Efficiency: Management uses balance sheet data to make strategic decisions that affect the company's operational efficiency and long-term growth.

How to Prepare a Balance Sheet

Creating a balance sheet involves several steps:

Step 1: Gather Your Financial Information

Collect all financial documents, including bank statements, invoices, receipts, and records of assets and liabilities.

Step 2: Classify Assets and Liabilities

Categorize your assets and liabilities into current and non-current.

Step 3: Calculate Total Assets

Sum up all current and non-current assets to determine the total assets.

Step 4: Calculate Total Liabilities

Sum up all current and non-current liabilities to determine the total liabilities.

Step 5: Determine Equity

Calculate equity using the formula: [ \text{Equity} = \text{Total Assets} - \text{Total Liabilities} ]

Step 6: Format the Balance Sheet

Present the assets, liabilities, and equity in the proper format. Ensure that the total assets equal the sum of total liabilities and equity, maintaining the accounting equation: [ \text{Assets} = \text{Liabilities} + \text{Equity} ]

Example of a Basic Balance Sheet

Here's a simplified example of how a balance sheet might look:

ABC Corporation Balance Sheet as of December 31, 2023

| Assets | Liabilities and Equity | ||

|---|---|---|---|

| Current Assets | Current Liabilities | ||

| Cash | $10,000 | Accounts Payable | $5,000 |

| Accounts Receivable | $15,000 | Short-term Debt | $4,000 |

| Inventory | $8,000 | Accrued Expenses | $3,000 |

| Total Current Assets | $33,000 | Total Current Liabilities | $12,000 |

| Non-Current Assets | Non-Current Liabilities | ||

| Property, Plant, & Equipment | $50,000 | Long-term Loans | $20,000 |

| Intangible Assets | $7,000 | ||

| Total Non-Current Assets | $57,000 | Total Non-Current Liabilities | $20,000 |

| Total Assets | $90,000 | Total Liabilities | $32,000 |

| Equity | |||

| Common Stock | $40,000 | ||

| Retained Earnings | $18,000 | ||

| Total Equity | $58,000 | ||

| Total Liabilities & Equity | $90,000 |

Conclusion

Understanding and effectively utilizing the balance sheet is paramount for anyone involved in managing or analyzing a company's financial position. By providing a comprehensive view of a company's assets, liabilities, and equity, the balance sheet serves as a vital tool for making strategic business decisions.

Ensuring accuracy and regular updating of the balance sheet can significantly enhance your financial planning and analysis, ultimately leading to sustained business growth and profitability.

For more detailed information on accounting and financial management, be sure to explore our other insightful articles and resources.

Download Now

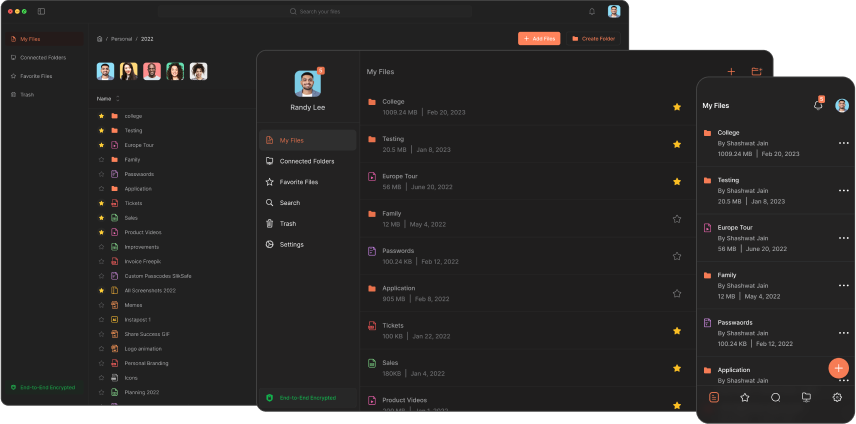

The Slikest Files Experience Ever Made